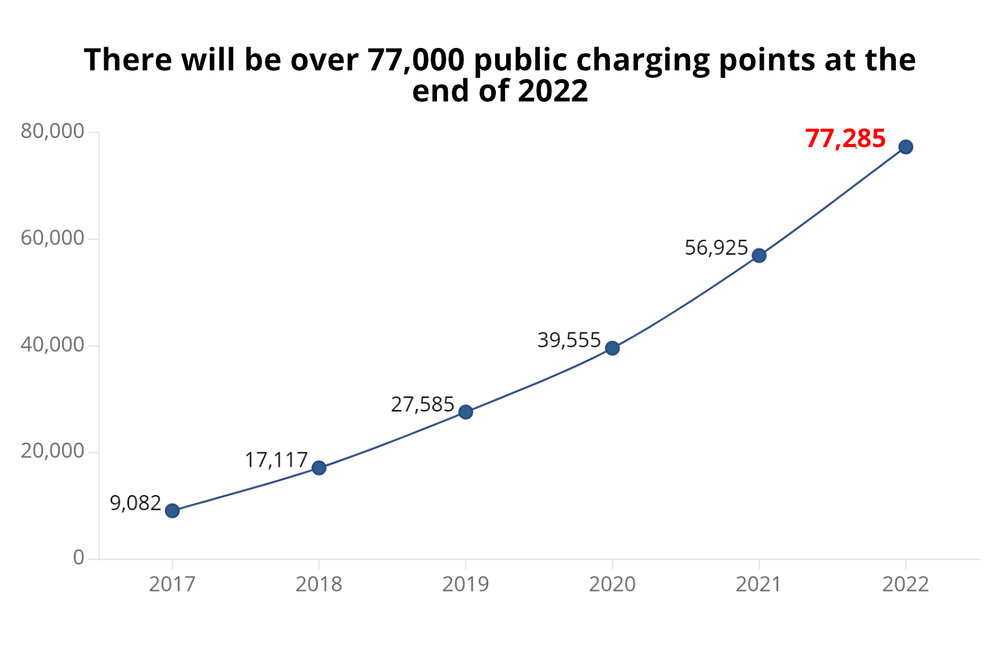

The number of public charging points at the end of 2022 was exactly 77,285. This means that more than 77,000 electric cars across Germany can be charged simultaneously on the public infrastructure. This is a significant increase compared to previous years. Five years ago there were still 9,082 charging points and at the very beginning of the expansion 10 years ago there were only 1,052 charging points.

Most charging stations are still equipped to charge two electric cars (average 1.9). The number of charging stations in one place is increasing, and in some cases entire e-mobility parks are being set up. Result: Today there are an average of 2.7 charging points per location, compared to 2.1 charging points in 2017.

The technologies for quickly charging electric cars are becoming increasingly important. A short charging time is necessary so that drivers can cover long distances reliably and without long breaks. With fast chargers with up to 350 kW charging power, a car can already be charged in less than 15 minutes. Nevertheless, the proportion of fast charging points (>22kW) at 11,621 is still only 15% of the total number and more normal charging points are still being expanded than fast charging points every year. This is mainly because fast charging is not possible or necessary everywhere and the costs for installation, operation and use are also higher.

Development of the charging infrastructure in Germany

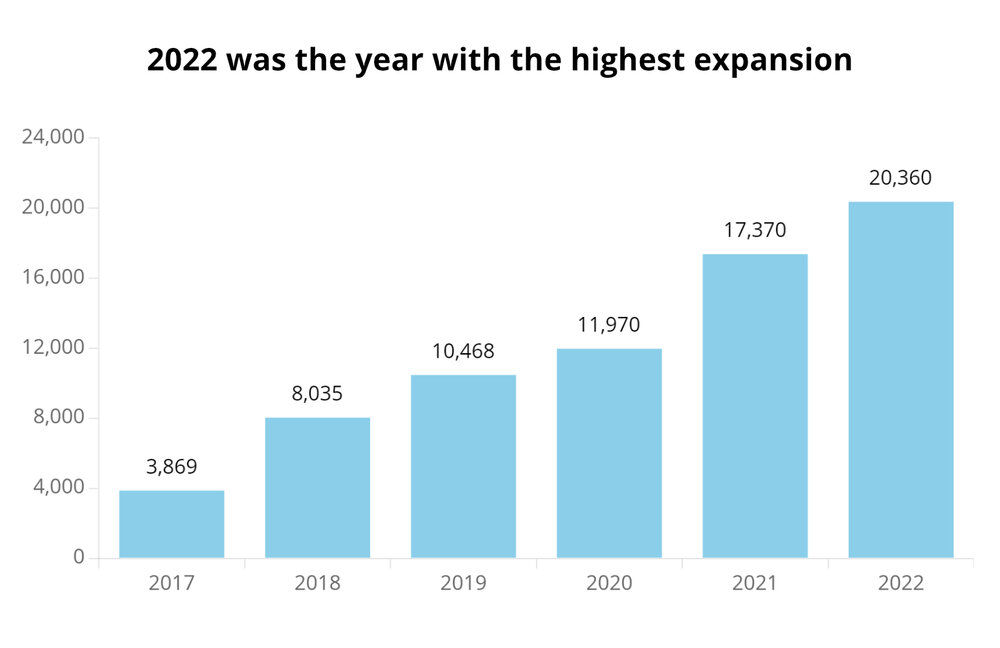

As in previous years, the expansion made strong progress and a new record was set again. There were a total of 20,360 new charging points in 2022 compared to the previous year. This means that 2,990 more new charging points were installed and made available in 2022 than in the previous year.

In reality, the expansion in 2022 is even higher. The reason for this is that not all data is always transmitted to the Federal Network Agency on time and processing the reports also takes time. In the past, for example, data relating to the year 2021 was only transmitted in 2022 and could only be incorporated into our application and analyzes upon publication. We expect late registrations of 7,691 charging points for 2022, which will further improve the expansion result.

Expansion record for 2022 and additional reports still expected

82.6% of the charging points added in 2022 are standard chargers and only 17.4% are fast chargers. Not only are normal chargers significantly ahead of fast chargers (15.0%) in terms of inventory (85.0%), but they also continue to represent the vast majority when it comes to expanding the charging infrastructure.

Although fast chargers have been able to improve their share of expansion from 12.2% to 17.4% over the last 5 years, they continue to show only a small increase. The big leap towards fast chargers will not happen for the time being and normal chargers will continue to dominate the expansion activity in the next few years.

Expansion share of fast chargers still below 20%

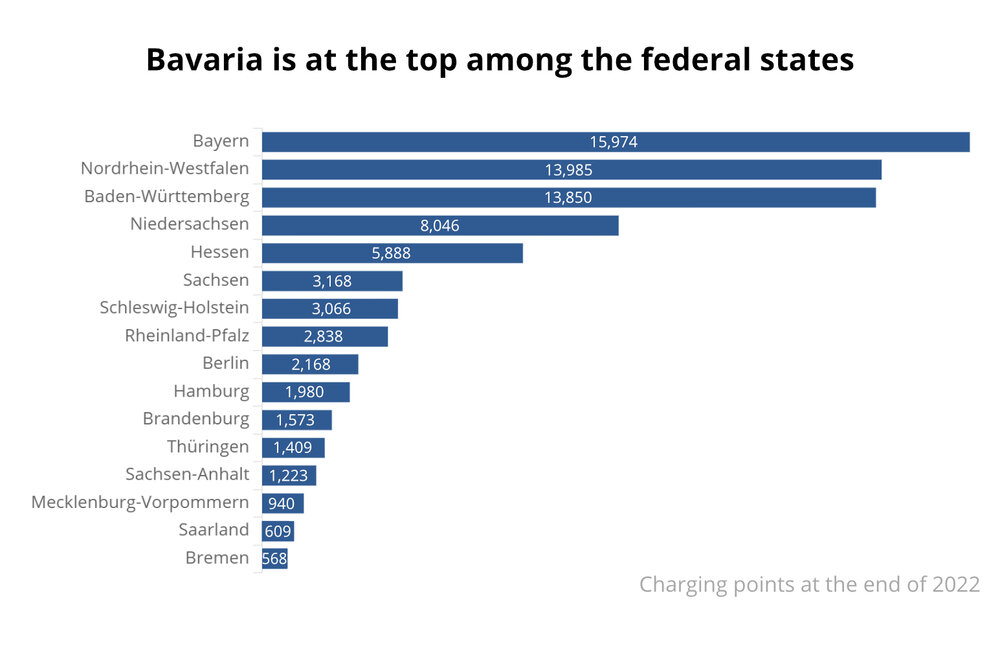

Due to the federal structures of the Federal Republic of Germany and the local conditions in the states, future topics such as the expansion of charging structures for electric vehicles are implemented with different dynamics and lead to significantly different results.

As expected, the results of the absolute number of charging points are led by the area states. Bavaria is ahead, followed by North Rhine-Westphalia and Baden-Württemberg. Federal states with low numbers of cars or populations, such as Saarland and the Hanseatic city of Bremen, are at the bottom of the table. Changes in positions compared to the previous year are only realistic between federal states that are of similar size or have very different rates of expansion.

Ranking of federal states by number of charging points

A targeted comparison of the results is possible if the number of charging points is compared to the number of registered cars. Hamburg clearly tops the list here with 2.43 charging points per 1,000 vehicles. Baden-Württemberg comes in second place and Bavaria will be in third place in 2022. In federal states with high values, switching to electric cars is most attractive due to the existing charging infrastructure.

The additional “cars per charging point” shown shows how many cars have to share a charging point. In addition to electric cars, the number of registered cars also includes normal combustion engines. Of course, these will not provide electricity, but the number also shows the necessity and demand that will arise with the further spread of electric cars.

Ranking of the federal states according to charging points per 1,000 cars

A similar sequence can also be seen when it comes to achieving the target requirements for 2030, which is based on the number of registered vehicles in a federal state. Hamburg reached a value of 26.8% by the end of 2022 and is well ahead of the following federal states of Baden-Württemberg and Bavaria. Overall, demand fulfillment is at a rather low level and on average the federal states only meet 17.6% of the forecast demand. Saxony-Anhalt and Saarland are also at the bottom here, with just a little more than 10%.

In the forecast for 2023, the order of the countries changes in many places. Bremen will probably work its way up to second place and other states such as Hesse, North Rhine-Westphalia, Lower Saxony and Brandenburg will also improve their position, highlighted in green. Hamburg, Saxony and the bottom three maintain their positions, highlighted in yellow. The remaining countries are deteriorating, highlighted in red. The biggest loser will be Berlin, which falls from 6th to 10th place.

Hamburg leads in meeting needs

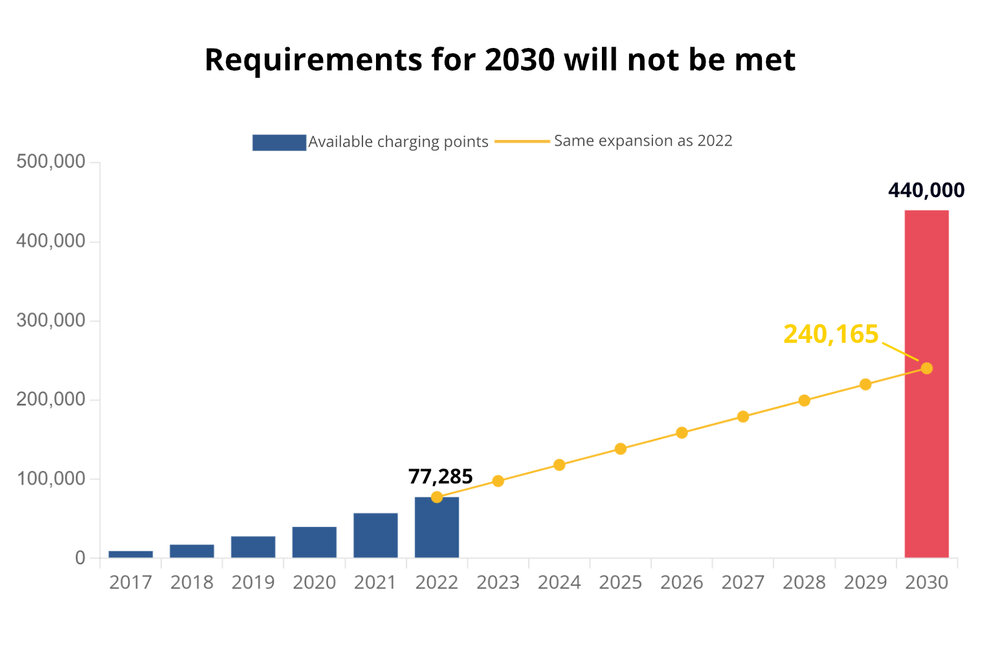

The electric future is on everyone's lips and the EU-wide ban on combustion engines for new cars from 2035 has been decided. In order to be able to successfully implement measures like these, a comprehensively developed charging infrastructure is required. According to a study by the National Control Center for Charging Infrastructure, Germany will need a total of 440,000 public charging points by 2030, other experts assume that the number of requirements will be even higher. But can this goal actually be achieved at the current pace of expansion?

If we assume that the expansion will continue at the same rate as in 2022, i.e. that 20,360 new charging points will be added every year, then there will be exactly 240,165 charging points at the end of 2030 (yellow curve). That's a little more than half of the goal.

However, if we assume that the same growth as we forecast for 2023 will continue to expand, then 35,108 new charging points would be added per year over the next 8 years (green curve). By the end of 2030 there would be 358,149 charging points, which would be 81.4% of the desired goal.

We always determine the forecast in our e-mobility application for the next 12 months using an exponential model (gray curve). Such a model is particularly used in forecasts for developing markets and is usually only used for shorter periods of time. If we also used this curve for the forecast up to 2030, the demand for 2030 would already be reached by the end of 2025. That doesn't seem realistic at the moment. With the further expansion of the charging infrastructure, saturation effects will also occur in the first districts in the next few years and the development curve will therefore flatten. Our forecast will adapt dynamically to these circumstances.

Predicted number of charging points by 2030

At the federal state level and the forecast for the end of 2023, the two city states of Hamburg and Bremen are at the top with around 35%. What should be highlighted is the good ranking of the states of Baden-Württemberg, Bavaria and North Rhine-Westphalia, which, as large states, play an important role in achieving Germany's goals. If they are particularly committed to the expansion, this will help disproportionately to Germany-wide progress.

According to our forecast, at the bottom of the list, with less than half of the target achievement of the top federal states, will be Mecklenburg-Western Pomerania, Saxony-Anhalt and Saarland. There is still a lot of development needed for these countries. They are far from meeting the 2030 target.

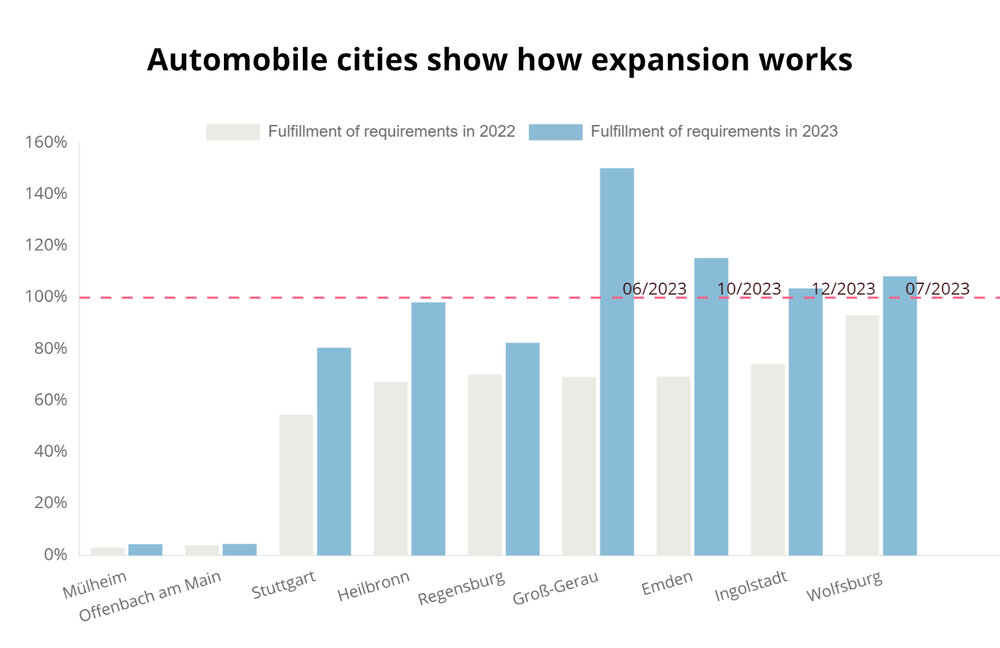

When looking at the ranking for meeting needs, it is noticeable that the first places are almost exclusively represented by districts with an automotive industry. These are: Wolfsburg, Ingolstadt, Emden (VW), Groß-Gerau (Opel), Regensburg (BMW) and Stuttgart (Mercedes-Benz). The only exception is the Heilbronn district.

Wolfsburg already covers 93.2% of the 2030 demand and will reach the 100% mark in July 2023 (Note: In current data from 2023, approximately 300 freely accessible charging stations have been retroactively removed. This will change the forecast given). Emden was at 69.4% at the end of 2022, but is particularly active in expansion and, according to our forecast, will reach the 2030 target as early as October. Groß-Gerau is making a particularly big leap and should be there by June.

At the other end of the list, however, there are districts in which expansion is making almost no progress at all. Such examples are Mülheim an der Ruhr with 3.1% and Offenbach am Main with 4.0%.

For the top 5 districts in meeting demand in 2022, we look at the development of the number of charging points again over a longer period of time.

In general, it can be said that significant expansion only began in 2017. Wolfsburg recorded a particularly high increase in charging points in 2017, with a sevenfold increase compared to the previous year and in 2020 with a further doubling of charging points. Regensburg and Emden present themselves with relatively continuous expansion measures and consistent growth. In contrast, Ingolstadt has been increasing its expansion measures since 2021 and is only surpassed by Groß-Gerau, which accelerated its expansion particularly strongly with a six-fold increase in 2020 and, according to our forecast, will reach its goal of 1,435 charging points for 2030 in 2023.

Development of the number of charging points from 2012 to 2023

Stuttgart, as another automobile city, has already come a long way with 54.7% demand coverage and, if the expansion continues at the rate from 2022 to 2030, would be able to provide twice the number of publicly required charging points. It will be interesting to see how the pioneers act in the expansion once the demand limit is reached in the following years and where they will set their future priorities.

Predicted number of charging points in Stuttgart by 2030

Mülheim an der Ruhr is a large, independent city in North Rhine-Westphalia with 170,000 inhabitants and a need for 870 charging points by 2030. Of these, only 27 had actually been built by the end of 2022. If the expansion progresses at the same speed as forecast for 2023, Mühlheim will not even be able to cover 15% of demand in 2030. Even if an exponential model is assumed, the goal will not be even remotely achieved. There are many districts like Mülheim that have only invested very little in the expansion of e-mobility and for whom the 2030 goal represents a major challenge.

Predicted number of charging points in Mülheim by 2030

As in the previous year, EnBW mobility+ is the largest operator of charging stations and, together with E.ON Drive, has a clear lead over third-placed EWE Go.

The following providers are usually very close to each other, which means that there are many changes in the order due to the different expansion in the last year. Mercedes-Benz made the biggest jump up, namely to 5th place from 23rd place, and Aral Pulse to 16th place from 24th place. SWD, Citywatt and Westfalen Weser Netz have also grown significantly and are in the top 25 for the first time. On the other hand, there has been a significant decline at Berliner Stadtwerke and IONITY. GP JOULE Connect (26th place), Comfortcharge (27th place) and VW Kraftwerk (35th place) are no longer in the top 25.

When classifying the leading providers by industry, it can be clearly seen that the vast majority are energy companies. There are also 2 automobile companies (Mercedes-Benz and Audi), 2 food retailers (ALDI SÜD and Lidl) and the gas station operator Aral.

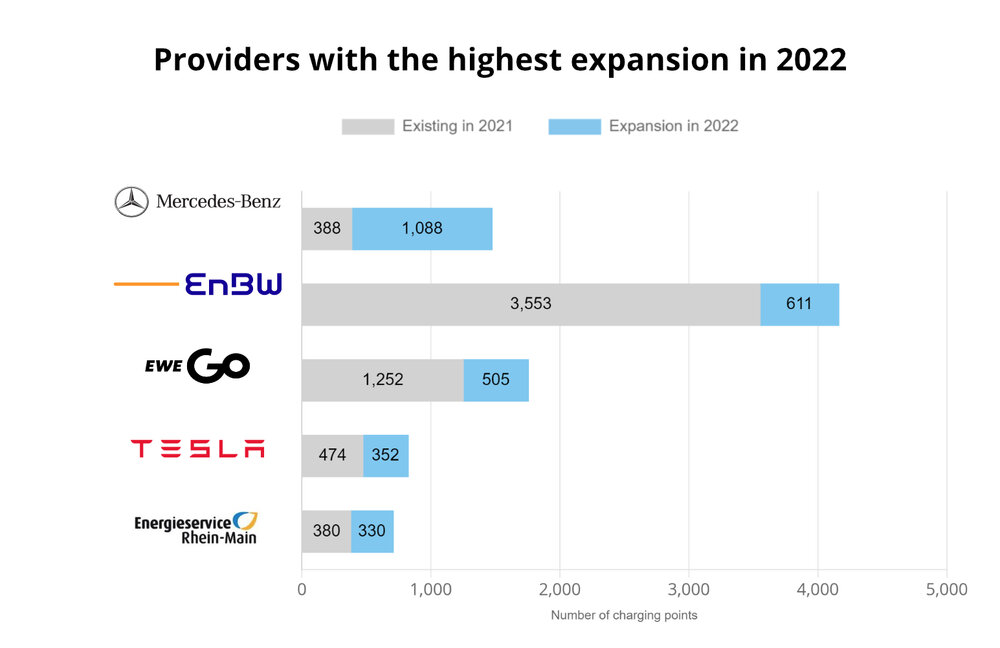

It is also interesting to see how committed the individual providers were to the expansion last year. Mercedes-Benz owes its first place to the fact that they were able to almost triple the number of charging points in one year. The commissioning of 1,088 new charging points is an impressive achievement. This is followed by the operators EnBW mobility+ and EWE Go. In 4th place is Tesla, which is now also represented in the statistics by opening 431 fast charging points for other car brands - further growth is expected in the coming years.

When examining the market breakdown by provider, it becomes clear that around 15% of the charging points are operated by the 5 largest providers. The first 50 providers account for almost half of all publicly offered charging points, while the remaining 4,901 providers operate the other half of the charging points. This means that there must be a lot of small providers of charging stations.

Distribution of charging points by provider

When the providers are classified into six size classes according to the number of charging points they operate, the assumption is confirmed that the majority of providers are small providers. In addition, it becomes clear that more than 50% are even small providers with only 1-2 charging points, which most likely corresponds to a single charging station.

Overall, there has been a significant increase in the number of providers: more than 1,000 providers were added last year, which corresponds to an increase of almost 30%. This also explains the growth in the number of providers across all size classes. Incidentally, 5 other providers exceeded the threshold of 1,000 charging points last year, these are: Mercedes-Benz, ALDI SÜD, Allego, Mer Germany and N-ERGIE Aktiengesellschaft.

By looking at the market shares of the top 10 providers in 2017 and 2022 over the last 5 years, statements can be made about the development of market participants. Today's market leader EnBW mobility+ was able to expand its share from 3.1% to 5.4% within 5 years. Mercedes-Benz, ALDI SÜD and Lidl, which were not yet among the top 10 in 2017, also recorded positive growth.

E.ON Drive GmbH was able to maintain its share of 4.0%. However, all other top 10 providers from 2017 have lost market share. The main reason for this is the influx of new market providers and the expansion of smaller providers. While the share of other providers was 59.7% in 2017, it had risen to 74.2% by 2022.

Development of the share of charging points from the top providers from 2017 to 2022

Charging points are not only being built in big cities but all over the country. For this study, we leave the classification by districts aside and look specifically at the cities and municipalities contained in the districts. According to our analysis, the charging points are distributed relatively evenly according to the population across large, medium-sized and small cities, with a slight advantage in cities with larger populations. 31.9% of the population lives in large cities and has access to 34.2% of charging points, 27.5% of the population in medium-sized cities has access to 30.4% of charging points and 40.6% of the population in small towns and rural communities has access to 35 .4% of charging points.

Distribution of charging points across large, medium-sized and small cities in comparison to the population

We were surprised by the distribution of fast and normal charging points. A look at the shares shows that large cities have the lowest share (12.0%) of fast charging points. Small towns and rural communities, on the other hand, have the highest proportion (17.5%).

When it comes to expanding charging points in 2022, small towns will also be leading the way with a larger proportion of fast chargers. Although the proportion of fast charging points is increasing in all city sizes, the greater expansion in small towns will allow them to further expand their leading role in the coming year. The reason for this could be that drivers, especially in rural areas, want to make a stopover at rest stops and recharge their batteries in a short time. This need is likely to be lower in large cities.

Proportion of fast charging points in large, medium-sized and small cities

There are over 2,100 small towns in Germany with more than 5,000 and less than 20,000 inhabitants. Although small cities have the most charging points overall, they have significantly fewer charging points than a large or medium-sized city. The leading small town of Garching near Munich has 116 charging points, 77 of which are in the business campus there alone. Schwieberdingen has 99 charging points, followed by Renningen with 95. These small towns have strong industrial settlements (including Robert Bosch GmbH), have climate protection concepts, car sharing, e-scooters or a city administration fleet of e-cars.

If you look at the corresponding federal state of the top 10 small towns, you can see that 7 of them are in Bavaria. Apparently, small towns in Bavaria are particularly committed to building charging infrastructure.

The top small towns have a very different distribution of fast charging points. Zusmarshausen impresses with a particularly high proportion of fast charging points (over 90%). The one there Sortimo Innovation Park When completed, it will be the largest charging park in Europe, offering 35,000 m² of attractive rest and shopping opportunities in addition to a variety of charging options and the first NIO battery exchange station in Germany.

Top 10 small towns with the most charging points

Forecasts and statements in the text refer to the data status as of January 1st, 2023.